TITLE COMPANIES “NOT OUT OF THE WOODS” YET ON COVERAGE

By Dave Krieger (Op-Ed) – September 10, 2012

When I was lecturing at the V. G. Young Institute’s annual Texas Clerks School in January, an interesting question was posed to me by one of the clerks (after having delivered a scathing presentation entitled MERS 101) regarding title insurance coverage.

“How is it that title companies can issue insurance policies when there are suspect issues with MERS and clouds on title?” she asked.

A great question, surprisingly. More surprisingly was my answer: “The title companies are merely ‘writing around’ the defects in the chain of title.”

I could see jaws dropping around the room. I continued with my answer:

“In virtually every title commitment issued there exists a ‘Schedule B: Exclusions’; under most every set of exclusions (generally under the 2nd or 3rd sentence), a title company can refuse coverage if the issue creating the problem isn’t recorded in the public records.”

More jaws dropped. They had put two and two together and things didn’t add up.

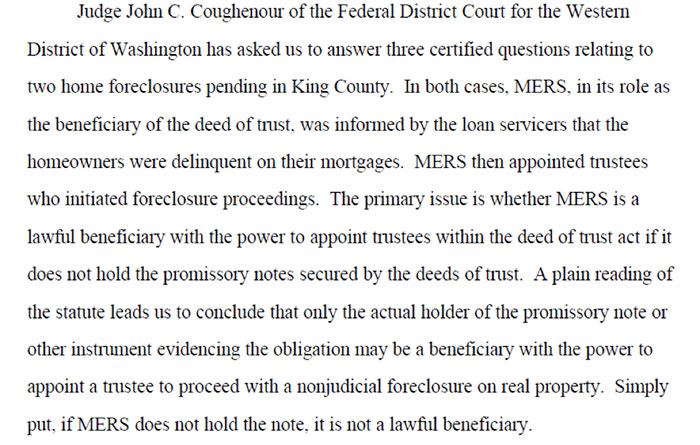

With the advent of the Bain v. MERS ruling (August 16, 2012) by the Washington Supreme Court, the landscape surrounding MERS’ ability to participate in non-judicial foreclosures has been vastly curtailed if not nullified with the ruling that MERS is not a valid beneficiary under the Washington Deed of Trust Act. The ramifications surrounding the yet-to-be-appealed decision are numerous and Stewart Title has now taken the liberty to introduce us to some of them … from a title company viewpoint as to insurability of title. Click here to download the .pdf version of that memo!

The “end game” for title companies appears to be on shaky ground and Stewart Title can now elect NOT to issue a commitment letter on REO (real estate owned) property that has been foreclosed on or is facing default, especially if MERS, Fannie Mae or Freddie Mac is involved!

That scenario in of itself creates a huge problem for the Washington real estate market, inevitably putting many REO and short sale transactions on hold. The Oregon Supreme Court may also uphold an appellate ruling that sticks it to MERS in much the same fashion as its neighbor to the north has. The Oregon real estate market is already feeling the ripple effect of that ruling. The shocking truth is however, is that if and when the litigation starts (and it will) regarding the fine points of this memo (regarding the legality of MERS to do anything and its subsequent involvement in any kind of improper foreclosure activity) Stewart Title and other major title companies that assisted in respective title searches and processing for these foreclosures on behalf of the major banks and their “trustees” could end up as defendants in costly and protracted litigation. Based on the inside track, Stewart and many of the other major title insurers have much to worry about.

The bigger problem is that despite the Washington Supremes’ ruling, MERS and its certifying officers are STILL FILING DOCUMENTS in the land records in Washington counties! Until the suits start flying and injunctions against this continued behavior start getting issued by the courts, things with MERS and the substitute trustees instituting these foreclosures will be status quo.

One can simply assume that the damages will be easy to prove; but robosigning, even though it still continues to this day despite the AG settlement, is not in of itself a crime. It’s what’s in the underlying meaning behind the act that is the real problem. Insurability of title is a real problem. It has been ever since MERS’ business model permeated the nation’s land records.

The title companies appear to be “in bed” (generally) with MERS. After all, the American Land Title Association was one of its founding members. Total irony, I know … a land title non-profit trying to tell MERS members and America’s rank and file clerks and recorders that their current system of records maintenance is too slow for securitization.

Couple the foregoing scenario with hordes of ignorant recorders, clerks, auditors and registers of deeds and you’ve got a recipe for disaster within the national land recording system on a massive scale!

It will take a century to clean up the mess that MERS and its minions created in 13 short years. No act of Congress can solve this problem. Give it 24 months … this issue will be in front of the U.S. Supreme Court. Once and for all I can say with a certainly, “Is that your final answer?”

This is an issue the courts largely choose to ignore … for now.