Reason #18 as to WHY you should have a chain of title assessment done BEFORE you buy a foreclosed home!

Posted: Feb 08, 2013 5:11 PM CST Updated: Feb 08, 2013 6:17 PM CST

By Dave Elias, NBC2 Investigator

LEHIGH ACRES, FL – A Pennsylvania couple recently purchased their retirement dream home in Lehigh Acres by using an online auction company. Ralph and Linda Donley paid $65,000 cash for the home only to discover an eviction notice on their front door months later.

“They say we own the house free and clear. I said we can’t. We’re getting evicted. How can it be ours?” said Linda Donley.

It turns out a second mortgage on the property surfaced and the home went into foreclosure.

“The title company didn’t do their job at all.” said Ralph.

The Donley’s did have title insurance. While they’re expected to get their money back they will not get money for upgrades they made to their home.

“I put new hurricane shutters on the home. That cost me $2,000.” said Ralph Donley.

Allen Olofson-Ring, a Realtor at Coldwell Banker, said he has never seen anything like this happen.

Donley, 81, has until Monday to vacate the property. The best advice to avoid this type of situation is to make sure you have title insurance when you purchase a home.

Title insurance MAY NOT save you if the mortgage isn’t recorded (see Schedule B for details) in the real property records. As to the last sentence of this story … I love it when TV news people hand out legal advice when they’re not attorneys. Online auction companies are NOT to be trusted due to the fact most of them disclaim accuracy for the information they post on their websites and further, most of them insist you indemnify them from all liability when purchasing property on their website! What kind of a “deal” does one expect to get when a prospective purchaser can’t even be bothered to check the real property records BEFORE making a purchasing decision? This is one reason why chain of title assessments are necessary. Smart investors know this! This is one reason why title companies are going to end up getting sued in the future. Can you imagine the negligence claims pouring into the E&O carriers?

WILLIAMSON COUNTY CLERK HOLDS PRESS CONFERENCE

(GEORGETOWN, TEXAS; January 29, 2013) — Williamson County Clerk Nancy Rister held a press conference following the presentation of the results of the audit of the official property records she commissioned last October. Joining her was Austin attorney David Rogers, an attorney who specializes in foreclosure-related matters and Dave Krieger, paralegal and author of the book Clouded Titles, whose firm, DK Consultants LLC conducted the audit of the Williamson County land records.

Out of all the documents reviewed, 1,576 files were pulled and examined, along with all of the files of the personal residences of every elected county official that had MERS in their chain of title. Every file reviewed had some issue involved with suspect robosigning, suspect surrogate signing, suspect notary fraud, suspect forgery, instances where lenders assigned the notes to themselves wearing the “MERS hat” and instances where servicers and third-party document manufacturing mills and processing centers self-appointed trustees or acted outside of the specific authority granted to them by power of attorney.

DK CONSULTANTS LLC PRESENTS COUNTY LAND RECORD AUDIT

By Dave Krieger

(GEORGETOWN, TEXAS) — The Williamson County Commissioners Court was presented with the final results of the real property records audit conducted in early October by DK Consultants LLC out of San Antonio. The Commissioners were shocked at the findings, which you can access by clicking here for the full report.

County Judge Sam Gattis instructed County Clerk Nancy E. Rister, who commissioned the study, to contact the newly-elected county attorney and investigate the matter further for future action by the County. The Board also heard from local Austin attorney David Rogers, who explained that “MERS’ business model is illegal in Texas”.

DK Consultants Managing Member and author of the book “Clouded Titles”, Dave Krieger called for the county district attorney to empanel a grand jury to investigate the foreclosure mill behaviors that MERS’s business model allows to run amuck without any regulatory oversight, specifically naming names of attorneys whose gross signature variations were called into question during the audit.

County Clerk Rister also announced that the county’s property fraud alert system was operational and that any time a document was recorded in the land records, the homeowner would be alerted by email to the document’s newly-recorded presence in the county land records.

Audit Reveals Trouble For Central Texas Homeowners

courtesy of JESSICA HOLLOWAY / KVUE NEWS kvue.com

AUSTIN — Homeowners in Travis County and Williamson County are discovering unsettling information about their mortgages.

County clerks are warning families that the ownership of tens of thousands of Central Texas home loans could be in question because of a company called Mortgage Electronic Registration System, Inc. or MERS.

It’s a private registry that officials say has failed to file proper documents with county clerk’s officers all over Texas and the United States.

According to the MERS website, the company was created in the 1990s by 3,000 of the nation’s largest lenders to “streamline the mortgage sale process by using e-commerce to replace paperwork.”

The site goes on to say it “is not a legal system of record nor a replacement for the public land records. No interests are transferred on the system. They’re only tracked.”

The Travis County Clerk estimates nearly 400,000 properties in the county are tracked by MERS and that the county has not collected at least $4 million in fees from documents that were never recorded.

Williamson County Clerk Nancy Rister estimates more than 70,000 properties in the county are in the MERS system. Rister said she learned that her own home mortgage had been sold to a new lender last year, yet her office had no record of the transfer.

VIEW Williamson County, Texas: REAL PROPERTY RECORDS AUDIT REPORT – January 29, 2013

How to check your mortgage:

For Travis County go to: http://deed.co.travis.tx.us

For Williamson County go to:http://www.wilco.org/CountyDepartments/CountyClerk/tabid/230/language/en-US/Default.aspx

WILLIAMSON COUNTY, TEXAS CONDUCTS LAND RECORDS AUDIT

By Dave Krieger, Managing Member, DK Consultants LLC, San Antonio, Texas

By Dave Krieger, Managing Member, DK Consultants LLC, San Antonio, Texas

GEORGETOWN, TEXAS – Williamson County Clerk Nancy Rister just issued a news release pertaining to an audit she commissioned last October of the real property records of her county. You can obtain a copy of her press release by CLICKING HERE.

The release comes on the heels of an announcement made by Jack Conway, Attorney General for the Commonwealth of Kentucky, who has filed suit against MERSCORP Holdings, Inc. and its subsidiary, Mortgage Electronic Registration Systems, Inc. for alleged violations of his State’s recordation statutes.

Austin area attorney David Rogers and I will be appearing before the Williamson County Commissioners’ Court on Tuesday, January 29, 2013, beginning at 9:30 a.m. to explain the results of the audit, which will be released the evening prior to our appearance before the Court. The media is welcomed to attend and it is our understanding that numerous residents of Williamson County also plan to fill the Court chambers.

Those who are not included on the list of email recipients for this audit report (over 140 pages including the legal opinion) are welcomed to access the .pdf version on this site on January 29, 2013. It will be provided in a separate announcement.

Any questions regarding the results of the audit or media inquiries may be directed to Dave Krieger through the email link on this website.

ATTORNEY GENERAL LORI SWANSON SCORES A VICTORY FOR MINNESOTA CONSUMERS!

By Dave Krieger, Managing Member, DK Consultants LLC

Author of The Credit Restoration Primer, 5th Edition

The Minnesota Attorney General’s office has released the Consent Judgment involving the case of State of Minnesota by its Attorney General, Lori Swanson v. Midland Funding, LLC and Midland Credit Management, Inc., Court File No. 27-CV-11-11510. You can download a copy of the Consent Judgment here! Kudos and salutations to Lori Swanson and her staff!

The Minnesota Attorney General’s office has released the Consent Judgment involving the case of State of Minnesota by its Attorney General, Lori Swanson v. Midland Funding, LLC and Midland Credit Management, Inc., Court File No. 27-CV-11-11510. You can download a copy of the Consent Judgment here! Kudos and salutations to Lori Swanson and her staff!

Upon reviewing this document, you’ll see that Ms. Swanson’s office was involved in countless hours of litigation on behalf of consumers in her State, resulting in over 200 sworn depositions and several rounds of discovery in anticipation of a trial.

Among other conditions, the Defendants have to vacate any judgments they were awarded against any consumer wherein their audit investigations (as of May 19, 2005) confirm that the person sued ever owed the debt in the first place (they can’t sell the debt to another debt collector either if that’s the case); in addition to coming into complete compliance with the Fair Debt Collection Practices Act. There is a complaint form that Ms. Swanson’s office has made available on its consumer website that consumers can fill out if they need further information about this judgment or involving any other debt collection matters.

While debt collection issues are not summarily the active concern of my consulting firm, the cause and effect of foreclosure cases is tainted credit files. The repositories (Equifax, Experian, Trans Union and Innovis) get their file information from the creditors. Unlike MERS however, which has no regulatory oversight, these repositories are under the regulation and jurisdiction of mandates established by Congress under the Fair Credit Reporting Act, which you can obtain a .pdf copy of at www.ftc.gov.

Concerning the actions of debt collectors, you can also obtain a copy of the Fair Debt Collection Practices Act on the Federal Trade Commission’s website. Generally, most if not all States have corresponding statutes that parallel (to a certain degree) the language proffered in the federal statutes. In some instances, like in California’s Rosenthal Act, that State drafted much of its own statutory mandates taken from the FDCPA; some with more “teeth” in them, some with less.

Of late are the issues wherein lenders (as creditors) are being challenged for violations of the FCRA in cases where the lender or the law firm attempting foreclosure can’t show that the alleged lender, as Plaintiff in the foreclosure action, actually owns the note they’re foreclosing on. If the lender doesn’t own the note, then what right do they have to report details of the payment history on that note on your credit reports? This is going to be a huge “tag-along” issue in future foreclosure litigation, especially litigation permeating the federal court systems.

I will keep you posted as to when the new version of The Credit Restoration Primer will be available, for those of you who wish to review the latest credit restoration issues and concerns, including case law and an updated index. Keep checking this website for more information.

WHO SAYS THERE ARE NO QUIET TITLE WINS?

By Dave Krieger (Op-Ed) December 14, 2012

A lot of homeowners are reading my book Clouded Titles. Many of them seem to appear disconcerted over whether quiet title actions actually work. Of late, the diatribe I get from some is that I appear to be “blowing smoke up their asses”.

Well … I have news for you:

CLICK HERE TO DOWNLOAD AN ORDER QUIETING TITLE (MISSOURI CASE)!

For those of you who doubt this action works and that you can’t challenge foreclosures using quiet title actions, think again. Just ask Missouri attorney Greg Leyh about the feasibility of such an action! If you’ve read the latest edition of Clouded Titles, Greg Leyh is one of the attorneys who has commented on my work. I’m not tooting MY horn here. I’m congratulating Greg for a job well done! Since you all wanted to see proof … now you have it! For every quiet title action my firm has been made aware of, there are probably ten quiet title actions we aren’t aware of. Rhode Island attorney George Babcock has also gotten some QT wins of late as well. There are attorneys out there who understand the concepts necessary to engage the “enemy” using these strategies.

Finding Competent Counsel

Part of the issues with homeowners seeking these actions is finding competent counsel. This is one of the reasons that the burgeoning network of paralegals and COTA Preparers out there is vetting attorneys, trying to find counsel that is willing to accept our research and case law as part of our litigation support. The attorneys call the shots here! I am not a lawyer referral service and neither is any given COTA Preparer out there. We are contacting attorneys and having conversations with them to determine: (1) whether there is any interest in pursuing this line of litigation; and (2) to provide counsel with contact information to help them succeed in winning these kinds of cases.

The foreclosure mills have support networks. I talk about them in my book. They are given gobs of information, for which the intended use is to foreclose on homes in America by whatever means are available. Unfortunately, new information has come to light that many of these mills aren’t “playing fair” and tend to “manufacture” documents using false swearing, robo-notaries and surrogate signing through the use of alleged hearsay information obtained through third-party information software platforms. One of our tasks as COTA Preparers is to keep our attorney friends “plugged in” with this new information once we receive it! Even attorneys that have superegos love us, because we want them to win! We are a team of dedicated professionals that seek to engage in “the fight” because we hold ideals true to the spirit and intent of what our forefathers fought for … liberty and justice for all!

This is why I conduct chain of title assessment (COTA) classes around the country. Because of my hectic schedule this year (with audits and COTAs and such), I am limiting my COTA 101 Workshops to six (6) in 2013. They are posted on www.cloudedtitles.com.

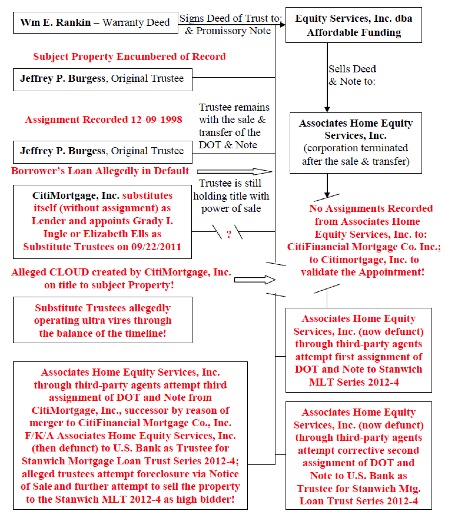

As part of the increased need for further training, I have extended the workshop to three (3) days instead of two days. This gives all COTA 101 attendees more hands-on applied advantages to actually performing the analysis necessary to put pen to paper. Attorneys have relied on COTAs in the past as part of case development. COTA analysis is extremely important, especially in determining the issues wherein potential clouds on title exist. Here is one such flow chart that I created as part of a chain of title assessment (this is a sample only and is not intended to be construed as legal advice):

Bottom line … there are NOT enough COTA Preparers to handle the onslaught and this scenario is not going to get any better without people who want to learn and help others get “into the game and fight”. If you are interested in getting involved, your emails are always welcomed through this website, attorney or concerned citizen.

AN “UP-TO-THREE-YEAR” PRISON SENTENCE DOESN’T JUSTIFY THE DAMAGE CAUSED BY ECONOMIC TERRORISM

By Dave Krieger (Op-Ed)

Today marks the 49th anniversary of the assassination of the late President John F. Kennedy. I’m quickly reminded of this point in time in our history because of the current state of the real property records in America. They’ve been assassinated too … only it wasn’t one quick pull of the trigger and it didn’t happen in one fleeting moment. It took years to achieve.

I can now successfully add former DOCX President Brown to the list of suspected economic terrorists (along with Kerri Panchuk from Housing Wire

I believe the damage count is into the tens of millions, especially if you live in a deed of trust state! What she agreed to in Missouri (even after pleading out on the federal level in Florida … another hand slap) doesn’t justify the economic damage that her firm, DOCX, created when it launched an avalanche of paperwork into the land records of every county in America on behalf of MERS and its member-subscriber banks, servicers and third-party document foreclosure mills.

It has become apparent that we can hold these document manufacturers criminally accountable.

That being said, good luck with understaffed county district attorney’s offices doing anything about it. Last October, I was in a meeting with a county DA who told me he didn’t have the resources in his white collar division to prosecute all of these wrongful foreclosures and robosigning that preceded them. I pointed out to him that it only takes one prosecution to send a message. If each of the over 3,000 counties prosecuted just ONE robosigning case and took down one major player … one foreclosure mill attorney … one robosignor … a handful of notaries who didn’t actually witness the signature of the person signing the document … we could imprison over 10,000 people and actually “send a message”.

What do you think that a notary or a robosignor is going to tell a grand jury about what they know about a document manufacturing plant like DOCX? They’re going to sing like canaries to save their own asses … that’s what! This is what the banks are afraid of. The banks don’t want any of this getting in front of a grand jury, because the common man is affected and reads the newspapers. The common man watches the continued blight in neighborhoods around him. The common man hears horror stories of people getting tossed out of their homes. The common man is just now starting to wake up to the reality that foreclosures are not only affecting those behind in their payments but also the property values of that very same “common man”.

So in lieu of prison terms, the banks set out to do what I call “damage control”. What is going on in the Oregon media, thanks to MERS mouthpieces like Housing Wire’s Kerri Panchuk (who calls herself a reporter), amounts to nothing more than economic terrorism.

Do you think that’s ever going to get prosecuted (even in light of Multnomah County’s decision to go after MERS while the Oregon Supreme Court decides the “beneficial” fate of the private electronic database)? Let’s extrapolate the potential damage for the moment to see exactly how much economic terrorism has occurred in the land records since 1999 …

You have at least 28-million reconveyances and satisfactions of mortgage that MERS and its agents have admitted they’ve filed in real property records. These reconveyances and releases of lien may have been signed by robosignors too! People with no personal knowledge of any of the stuff they’ve attested to. How do they know you’re loan has been paid off? They don’t! They’re sitting in some signing room in Montana or Florida or Texas or … They might have a computer screen handy to read what alleged figures might be possible; oh, wait, isn’t that hearsay? Where did they get those figures from? How do we know the loans weren’t paid off ab initio? How do we know we’re paying the right lender? How do we know we have clear title?

On average, it will cost the average homeowner $15,000 in legal fees to quiet title to their property (provided the banks don’t jump in and attempt to file motions to dismiss instead of answering the bloody lawsuit like they’re theoretically supposed to) and someone should be held accountable. Someone has to pay for the economic damage, right? Whose negligence caused this mess in the first place? Didn’t somebody realize the cause and effect of recording documents in the land records that purport to claim one thing, when in reality it may not be the case?

The real problem here is that most American homeowners (the other 89% that are unaffected by foreclosure at this point) aren’t paying attention. How about $420-billion for just the first set of reconveyances in average costs of quieting title ($15,000 x 28,000,000 MERS-alleged releases of lien)? I estimated earlier that over 70-million properties are affected and I haven’t even touched on the assignments yet!

In deed of trust states, you’ve got at least four pieces of recordations at stake … an assignment (which is undetermined as to its “manufactured” value) that there’s a better-than-average chance was robosigned; an appointment of successor trustee (many of which were manufactured by the very foreclosure mills that were being ordered by some servicer to handle); a notice of default and sale (which may or may not have even been recorded as required by statute in some states); and a trustee’s deed (if in fact the property went to sale). All of these documents come “into play” in non-judicial foreclosure states in clouding a property owner’s title. In judicial states, you’re most likely dealing in missing (or phony) documents purporting to create issues with title.

When homeowners don’t act, the banks win. When banks are allowed to use mouthpieces to terrorize homeowners and small business owners into submission (vis a vis Oregon and MERS potential legal outcome … notice Panchuk’s piece in Housing Wire came out right after Multnomah County announced it was going after MERS? … that was no accident … it’s called damage control!), everybody loses. If the states wanted to “fix” this situation, they’d start prosecuting cases and going after convictions instead of plea bargains. That way, the banks they’re going after would be less inclined to put any PR out in front of the general public, insinuating economic collapse if MERS wasn’t given a “go-pass” by the Oregon Supremes. Again, that’s economic terrorism in my book and the Oregon Supremes need to stay the course and do what’s right for Oregonians and send a message to the banks and MERS: ENOUGH!

IF THE MONTGOMERY COUNTY RECORDER’S CASE VERSUS MERS WERE A CHESS GAME … MERS JUST LOST ITS QUEEN!

“For the reasons so stated, the Defendants’ (MERS) Motion to Dismiss is granted as to Count II of the Complaint, alleging civil conspiracy, and denied as to the remaining counts.”

“For the reasons so stated, the Defendants’ (MERS) Motion to Dismiss is granted as to Count II of the Complaint, alleging civil conspiracy, and denied as to the remaining counts.”

In a 35-page Memorandum and Order, U.S. District Court Judge James Curtis Joyner (E. Dist. Pa.) dismissed Montgomery County Recorder of Deeds Nancy Becker’s claim for civil conspiracy, but left intact her claims, as part of a putative class action on behalf of all other Recorders in Pennsylvania, that could force MERS and its member-subscribers to record every single missing document to every single MERS mortgage to perfect each property owner’s chain of title and pay the appropriate fees due at the time of recording.

You gotta love this woman’s chutzpah, to move forward and take on a multi-billion-dollar-a-year private electronic database that she alleges in her case, has wreaked havoc on over 130-thousand mortgage filings in her county alone.

In the Memorandum and Order Joyner issued October 19, 2012, Becker would be allowed to pursue a quiet title action against MERS and MERSCORP, Inc. and seek declaratory and injunctive relief to boot. Becker filed the suit on November 7, 2011, alleging that “MERS was formed for the express purpose of avoiding fees traditionally due to county recorders of deeds when sales or assignments of mortgages were made. She further pleads that the absence of these recorded assignments as part of the Defendants’ avoidance of recording fees both deprives her office and Montgomery County of revenue needed to support vital public functions and creates deficient property records.” (Emphasis supplied here by the author herein) This is what I’ve been alleging ever since I wrote Clouded Titles. It’s not just about the money; it’s about the destruction of chains of title that every MERS mortgage or deed of trust ever touched.

Also cited in the Memorandum were the cases against MERS and MERSCORP in both Dallas County, Texas and Geauga County, Ohio, both of which are still in play. MERS attempted through various ploys to get itself dismissed from the complaint in Dallas County by removing it to federal court; subjecting it to the Multi-District Litigation (MDL) backpanel in Arizona, only to find itself back in federal district court in Dallas in the same fashion, dismissed in part and denied in part. There’s still the issue of a Texas statute at § 192.007 (Texas Government Code) that requires ALL subsequent assignments and transfers be recorded.

This author and his audit team just completed an audit of a county’s land records, to discover multiple issues that could spell fate not just for the Reston, Virginia-based MERS/MERSCORP, but also for multiple attorneys whose signatures appear as wide and varied as Linda Green, the infamous robosignor exposed in CBS’s 60 Minutes piece in April of 2011. Like other counties, the audited county suffered the same dilemma as Pennsylvania Recorders in a drop of badly-needed revenue due to the lack of recordation of transfers and assignments once the initial MERS mortgage or deed of trust is recorded.

As usual, MERS’ attorneys argued a wide range of assertions, including their claim that Becker did not “invoke the availability of quiet title relief in her pleadings. Nor did she argue that the facts she pleaded state a quiet title claim.”

Alas, quiet title will out. The Court took several pages of the Memorandum to discuss the construction and interpretation of what the Pennsylvania Legislature intended when it created the original quiet title statutes; repealed and revised same; and came up with enough conclusive discussion to keep MERS and MERSCORP locked into this lawsuit, concluding “that the Plaintiff (Becker) has pleaded sufficient fact to proceed on her unjust enrichment claim …”

I know it seems like there was a consortium of banks and mortgage associations out there that helped mold this electronic database into the monster that it has become in the legal arena and the nightmare that it has become in the land records, obfuscated by a largely unregulated, privately-held database that seems to work in opposition to the system of public recordation that has existed since the 1600’s. In retrospect, the pleadings for civil conspiracy (as much as we’d like to form a lynch mob on this one) were insufficiently pleaded and for all intents and purposes were a “reach”; but hey, every other claim, including the discussion of 21 Pa. Stat. § 351, which would require recordation of all mortgage assignments, stuck. On Page 14, the Court wrote:

“Accordingly, we conclude that “all … conveyances … shall be recorded,”

21 Pa. Stat. § 351, means that all conveyances shall be recorded.

How much more plain can you get? The Court also concluded:

“Pennsylvania law permits any person in any manner interested in a conveyance,

(including the County Recorder of Deeds trying to preserve the land records)

such as a mortgage assignment, to bring a quiet title action under Pennsylvania Rule

of Civil Procedure 1061(b)(3) to compel the person with the appropriate documents

in his or her possession to record them.”

What a novel idea … use quiet title to compel MERS (by and through its members) to record every single missing assignment to perfect every single land record in the State of Pennsylvania … and pay the recordation fees it should have paid in the first place to boot! This suit may serve as a template for other counties and states to follow, especially if the outcome looks as promising as the content of this Memorandum.

And so case No. 11-cv-6968 in the Eastern District of Pennsylvania moves forward with all eyes watching, waiting for the checkmate.