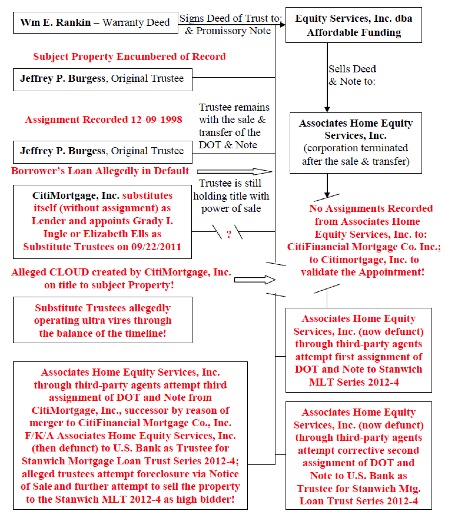

Reason #18 as to WHY you should have a chain of title assessment done BEFORE you buy a foreclosed home!

Posted: Feb 08, 2013 5:11 PM CST Updated: Feb 08, 2013 6:17 PM CST

By Dave Elias, NBC2 Investigator

LEHIGH ACRES, FL – A Pennsylvania couple recently purchased their retirement dream home in Lehigh Acres by using an online auction company. Ralph and Linda Donley paid $65,000 cash for the home only to discover an eviction notice on their front door months later.

“They say we own the house free and clear. I said we can’t. We’re getting evicted. How can it be ours?” said Linda Donley.

It turns out a second mortgage on the property surfaced and the home went into foreclosure.

“The title company didn’t do their job at all.” said Ralph.

The Donley’s did have title insurance. While they’re expected to get their money back they will not get money for upgrades they made to their home.

“I put new hurricane shutters on the home. That cost me $2,000.” said Ralph Donley.

Allen Olofson-Ring, a Realtor at Coldwell Banker, said he has never seen anything like this happen.

Donley, 81, has until Monday to vacate the property. The best advice to avoid this type of situation is to make sure you have title insurance when you purchase a home.

Title insurance MAY NOT save you if the mortgage isn’t recorded (see Schedule B for details) in the real property records. As to the last sentence of this story … I love it when TV news people hand out legal advice when they’re not attorneys. Online auction companies are NOT to be trusted due to the fact most of them disclaim accuracy for the information they post on their websites and further, most of them insist you indemnify them from all liability when purchasing property on their website! What kind of a “deal” does one expect to get when a prospective purchaser can’t even be bothered to check the real property records BEFORE making a purchasing decision? This is one reason why chain of title assessments are necessary. Smart investors know this! This is one reason why title companies are going to end up getting sued in the future. Can you imagine the negligence claims pouring into the E&O carriers?

By Dave Krieger, Managing Member, DK Consultants LLC, San Antonio, Texas

By Dave Krieger, Managing Member, DK Consultants LLC, San Antonio, Texas The Minnesota Attorney General’s office has released the Consent Judgment involving the case of State of Minnesota by its Attorney General, Lori Swanson v. Midland Funding, LLC and Midland Credit Management, Inc., Court File No. 27-CV-11-11510. You can download a copy of the Consent Judgment

The Minnesota Attorney General’s office has released the Consent Judgment involving the case of State of Minnesota by its Attorney General, Lori Swanson v. Midland Funding, LLC and Midland Credit Management, Inc., Court File No. 27-CV-11-11510. You can download a copy of the Consent Judgment