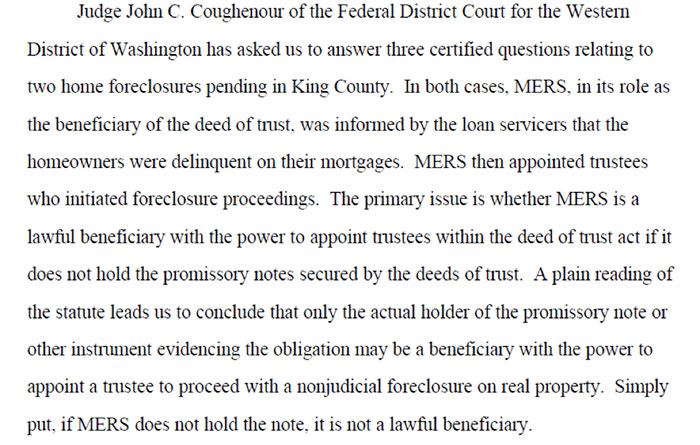

It was a glorious day for homeowners in the State of Washington. The entire court reviewed the Bain v. MERS and Selkowitz v. MERS cases in the questions put before them, as follows:

The legal consequences of this ruling (download it here in pdf format) have yet to be felt … but I can foresee the possibilities. One would wonder whether the arrogant PR Department inside 1818 Library Street is going to huff and puff and take this ruling to the United States Supreme Court to see whether the U.S. Supremes will even hear this case. The way the Justice Department is behaving regarding its refusal to prosecute any of the evildoers in the banking and securities industry may not equal the power of the nation’s highest court and what it could do (nationally) to Mortgage Electronic Registration Systems, Inc.

This reporter figures that the Oregon Supreme Court is going to follow Washington’s lead and thump MERS a good one when it issues its ruling. Remember the old saying about letting a sleeping dog lie? Ah, the arrogance of MERS! Perhaps it may wish to rethink which counsel is going to go to DC and tell the U.S. Supremes that borrowers don’t need to know who owns their note too! Talk about fallacies! That’s the arrogance I was talking about!

Now let’s talk about condition of title … something MERS and the banks DIDN’T get a legal opinion from Covington & Burling specifically about. It will take a century to clean up the mess made by MERS in a little over 13 years.

The chain of title assessment (COTA) is going to become a household word because the mainstream media is going to start discussing how 70-million potential homes in America can’t be sold because the average reasonable and prudent buyer wouldn’t spend a plugged nickel on a real-estate-owned (REO) property knowing the possibility its title could be clouded, not to mention the fact there’s probably an indemnification agreement attached in that contract holding the alleged lender harmless from all liability connected with the sale of the REO.

The legal effects of MERS not being able to “assign” anything or “appoint” anything … in of itself … shocks the conscience! Open up any land record of any home affected by a MERS mortgage or deed of trust and imagine the litigation it will take to clear title to all those affected properties … all because MERS thought we’d be resorting to a national land title system. Geez! More arrogance!

Realtors who ignore this ruling are asking to be named as Defendants in a lawsuit involving tainted titles. Brokers are complaining to me that they can’t afford a legal challenge to their involvement in a lawsuit of this nature. They may be held NOT to be liable somehow, but the legal costs of getting out of a suit like that could drive real estate agencies into bankruptcy! Imagine the potential liability pitted against your real estate brokerage’s financial condition if all you sold was REO’s and short sales and “the hens came home to roost” because of this latest ruling?

This isn’t over yet my friends.

This is just getting started.