WHOSE SIDE ARE YOU ON ANYWAY?

By Dave Krieger

Stewart Title has erred on the side of caution in its stance against issuing title policies on foreclosed properties due to the “robosignor snafu” that may have effectively clouded those titles. Stewart joins Old Republic Title in its effort to “stop the bleeding” via limiting its exposure to claims by denying Ally Financial-GMAC Mortgage’s REO properties due to admissions by one of its robosignors, Jeffrey Stephan, that he signed thousands of documents without having personal knowledge as to their contents and then having them notarized to appear “official”. Later, Beth Ann Cottrell, working for Chase, made similar admissions under deposition.

Chicago Title has been issuing commitment letters with exclusions and conditions for quite some time in an effort to cover itself against illegitimate claims. However, in the wake of all of this, the CEO for American Land Title Association, Kurt Pfotenhauer is downplaying this whole “cautious” thing, saying (along with Rick Sharpa of RealtyTrac) that this is much ado about nothing. Of late, Steve Bartlett, former Dallas mayor, Congressman-turned Wall Street lobbyist, told Bloomberg News in effect that the 50 states attorneys general should effectively “butt out” of the investigations by Congress in determining the legality of the court and county-recorded filings created by these robosignors that played into the hands of the lenders.

While I take issue with ALTA’s and RealtyTrac’s stance on this whole affair, I have to stop and ask myself every time one of these “slanted” views comes forward, its like, “Whose side on you on here?”

Sharpa, like so many others, seems to believe that challenges to these document snafus are just another form of “prolonging the inevitable”. Inevitable for what? Losing your home so the real estate market can “right itself” and properly hit bottom? This is NOT all the consumers’ fault fellas. They may have come begging under the pretenses of the American Dream, but the lenders certainly didn’t have to cater to them … that is … unless there was some other underlying agenda in mind (uh, er, having to do with securitization of RMBS’s on Wall Street?).

Frank and Brian, the two fast-talking pontificators that drop YouTube videos through ThinkBigWorkSmall.com actually came out saying that MERS was a “good thing”? Geez. If Mortgage Electronic Registration Systems, Inc. (MERS) was such a good thing, then why did JPMorgan Chase jump ship? Why did MERS CEO R.K. Arnold post an apparent “damage control” press release espousing the value of MERS four days prior to JPMorgan CEO Jamie Dimon’s announcement? Is it because he knew that maybe more than just JPMorgan was going to say goodbye to their system of electronic recordation in the face of public and potential criminal scrutiny?

What sadly rears its ugly head (again) is the “business world of banking” taking issue with the “less than frivolous and foolish consumer”, who went out and bit off more than he could chew. Is it not only right that the 50 states AG’s should at least explore WHAT happened behind the scenes, even if this smacks seemingly of an “October surprise”?

Public suspicion also mounts because of the concerns over the bleak economic picture of America, considering the fact that real estate sales play an important role in the overall GNP picture. Everyone is affected by this mess, not just the foreclosed homeowners. Until we “clear the air”, every politician and every banker is going to get a sideways look from every consumer in America. We wait with baited breath to see what Congress won’t do next.

As for the title companies, let them err on the side of caution. It’s not only proper as a defense mechanism, it’s just smart business. I predict the insurance companies through the E&O carriers are next to get hit as the legal claims start flying in the face of clouded titles. Just remember there is a time when the title company could be your best friend instead of your worst enemy when it comes to legal pursuits.

As for ALTA, watch for membership in-fighting, because it’s coming!

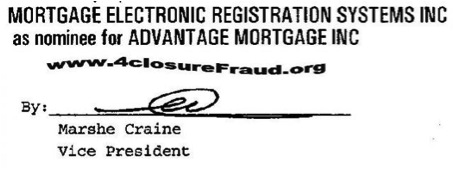

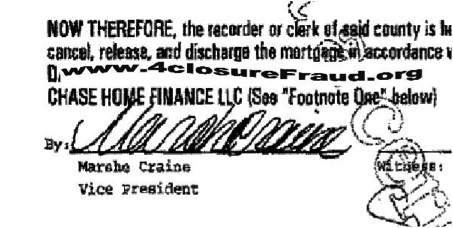

Do they look even remotely similar to you? Now let’s get the notary that notarized BOTH of these documents and check out their signatures. First, the Obama paperwork notary:

Do they look even remotely similar to you? Now let’s get the notary that notarized BOTH of these documents and check out their signatures. First, the Obama paperwork notary: